From Spreadsheets and Computer Code to Business Rules: A Business Rules Approach to Decision Point Analytics

For over a decade, the business rules approach has become standard practice in many industries, especially insurance, health care, and finance. Fundamentally, the business rules approach creates agreement, clarity, and constancy for guidelines, constraints, and policies. This precision, often ratifying things unclear or conflicting, vastly improves the operating constancy and agility of the organization. Most business rules analysis, especially high-level policies and guidelines, focuses on facts, relationships, and logic. Yet at a deeper, operational level, an organization's business rules also encompass decisions that are aided by analytics — how an organization arrives at optimal or realistic decisions based on existing data.

The Business Rules Approach and Business Rules Management Systems have primarily evolved from two sources. First, Ron Ross' The Business Rules Book revolutionized requirements gathering by unifying and standardizing the language of managers, analysts, and technologists. The approach developed rules with a factual, business vocabulary-driven approach. Next, vendors of Business Rules Management Systems (BRMS) directed this standard language, or output, to varying degrees, directly into software. Early BRMS controlled logic in the form of facts and predicate logic (if-then-else) or domain-specific languages.

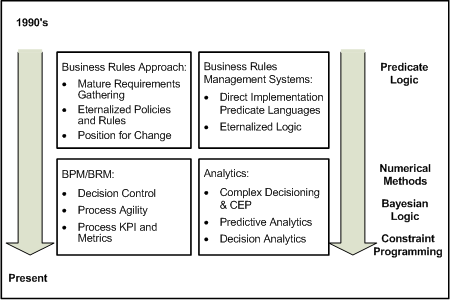

Recently, two wider trends have expanded the scope of the BRMS. First, with increasing adoption of business process management (BPM) methods, modeling, and technology, organizations have incorporated rule-supported decisions. Second, high-performance organizations have expanded analytics' role in core process decisions and complex events. While analytical methods have been external to the BRMS, they increasingly play a role in rules-based decisioning, especially in finance, risk, and security. One way to view this expansion of the role of the BRMS is shown in Figure 1.

Figure 1. The Expanding Role of the Business Rules Management System

All the developments shown in Figure 1 continue to be relevant. It is our experience that, after an organization begins to govern their business decisions, their business rules' logic incorporates more computationally-complex requirements. These rule-sets have many layers, contexts, and structures.

The mathematical models in the modern BRMS broaden the scope of solutions. Moreover, many details of mathematical models are not amenable to semantic or contextual analysis (i.e., fact modeling). Different analytical methods must be applied in conjunction with standard business rules approaches. Synonymous with the objectives of business rules, the goal is to put analytics into the hands of business, lighten the load on IT, and reduce software development life cycles. The approach designs solutions with business users in mind.

A common misconception is that analytics uses only an external, 'top-down' or process-level view of data to discover patterns and improve decisioning, as in data mining. Analytics also includes analysis of information at the point of decision. It is probably today's most common usage, and I call it 'decision-point' analytics.

The use of analytics, mathematical models, and numerical techniques is a growing practice, especially in finance. One field, numerical methods, is an essential tool in finance. Numerical methods arises from a unification of mathematics, numerical analysis, and finance. It is a tool used in a wide range of finance topics, from credit risk rating, portfolio management, and asset pricing, to performance, risk, debt, and other areas.

Organizations digitizing computationally-complex decisions use simple (predicate) business rules in conjunction with analytic business rules to improve decisions. The analytic business rules conduct analysis of variable economic, environmental, and market factors. These decision-focused rule-sets employ a variety of cutting-edge analytical approaches and techniques, including robust control, min-max optimization, Bessel processes, stochastic viability, variational inequalities, and Monte-Carlo test techniques.

Decision Point Analytics in the Real World

Credit Risk Rating

One area where analytic techniques are encountered is in the Basel II, Credit-Risk process. For instance, in an Advanced Internal Ratings Based (IRB) Approach, the probability of default (PD) is computed using a weight-adjusted set of objective and subjective factors. For real estate financing, subjective factors for credit-risk modeling include the debt service coverage ratio (DSCR) and the loan-to-value ratio (LTV). For corporate financings, objective factors include income, operating profit, and totals of assets and liabilities. In different portfolios, subjective factors in the rule-set might include the quality and experience of management. A different credit risk model would apply to different types of loans in the portfolio. Predicate logic for a risk management system includes governance business rules that direct a credit analyst or loan underwriter to the most appropriate rating model and prevent 'cherry-picking'.

Yet, credit risk is often computationally complex. If the counterparty is using an asset, subject to market volatility, to collateralize the debt, then the value of the asset might need a reasonable 'haircut' to determine a fair value. In a Monte-Carlo approach, the value is randomized according to a distribution and the resulting value-time relationship is integrated. The analytic business rules implement this logic as a series of logic trees, loops, and expressions — the same logic environment that governs selection of the proper model, validates the completeness of data, and selects the proper weight-adjusted factors. Because the rule structure for the Monte-Carlo algorithm is externalized in the same framework, the solution is more exposed and traceable.

Currently, conventional and analytic business rules for computationally-complex credit rating are used by many international financial institutions with the Basel II IRB-Approaches.

Derivatives Trading

Another area where we encounter decision-point analytics is in the field of derivatives. Derivatives are products that manage risk or 'hedge' against the effects of change. Derivative contracts are purchased to generate a cash flow that is equal in magnitude, but opposite in direction, to the change in the asset. A wide range of different types of derivative contracts is available, and each might be modeled with many candidate analytics. A business-rules derivatives application shares both the governance and selection characteristics of credit risk. It also shares the need to support computationally-complex business rules. Again, as in credit risk rating, derivatives applications combine the logic of model selection and analytic business rules. Often, analytics is a formulation of the Black-Scholes equation, which is very similar to the Monte-Carlo approach to pricing an asset.

Business rules have modeled pricing algorithms for a variety of complex derivatives, for several large trading firms.

Spreadsheets and Business Rules

Previously, organizations creating digitized solutions with analytics had two choices: either develop the solution in unwieldy spreadsheets, or implement the solution in computer code. Both have the same problems of hand-coded software:

- Notoriously complicated to maintain.

- Usually only a single subject matter expert or programmer understands it.

As previously described, analytic results are just one factor of many in a computationally-complex decision. Importantly, business rules select the proper model and then 'score', rate, or otherwise evaluate the result in concert with other factors.

Many organizations we encounter use business rules to overcome the limitations of spreadsheets. They move to business rules because spreadsheets are unacceptable as an enterprise integration tool. Furthermore, a spreadsheet is notoriously difficult to construct with the objective of ensuring consistent model usage. As a result, application development professionals (or spreadsheet owners) become a bottleneck, and financial managers cannot respond quickly to changing market and regulatory requirements.

Fortunately, the business rules approach offers a solution to this. In our business rules practice, we often encounter spreadsheets as scorecards, computations, value assignments, or a combination. One might assume that a spreadsheet like this would merely translate into a series of decision tables. Modeling these spreadsheets is more nuanced.

Migrating computationally-complex decisions from spreadsheets into a business rules solution requires an analysis of: the spreadsheet, the data structure implicit within and the logic of cell macros, and the supporting Visual Basic. There are usually three types of spreadsheets:

- A fully functioning computational spreadsheet.

- A sequence of conditional value assignments.

- A value-weighted 'scorecard'.

Often, these arise in the security, financial, or credit risk rating areas. The logic of the business rules follows the logic of the spreadsheet — flowing from right to left and top to bottom.

The tasks to migrate a spreadsheet into a BRMS are similar for most spreadsheets. First, we isolate the decision or decisions that are made by the spreadsheet's logic. Next, we build a hierarchy of rule-sets that 'normalize' the logic and promote reuse across decisions. We discover the high-level steps of the decision and build a business explanation for the steps and alternates. Having identified the sequence and flow of the spreadsheet's decision logic, we then create 'rule flows' and decision tables for each branch of the logic. For a computational column, we create a flow of computations. If the worksheet is a straightforward 'value look-up', we create decision tables.

If an area of the spreadsheet is a simple sequence of conditions and assignments and it is a concise way to decide a proposition, we might use decision tables. For instance, in credit risk rating we use a decision table to assign the standard Basel-II risk weight-categories. We have found that overuse of decision tables complicates a model, especially if the decision table is asymmetric — that is, if there are many exceptions and 'special-cases' to the assignments.

There are many different strategies for integrating these business rules into IT architecture. Often there are pre-existing 'business objects' and database tables. Experience has shown that business analysts need familiar terms. Attribute or column names embed technical details (data type, object, or table name) of the data item and reduce the simplicity of business rules maintenance. To avoid this it is best to create local business objects that map to these technical terms.

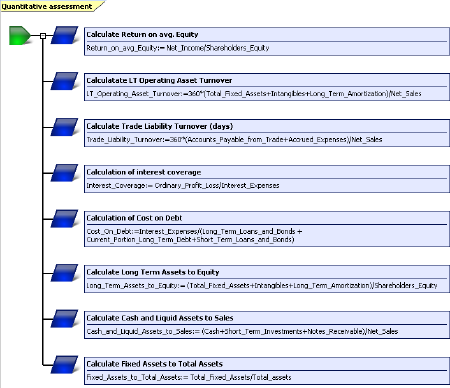

As the logic of the spreadsheet moves into business rules, formulas are encountered. Formulas in spreadsheets can be difficult to understand and difficult to read. Moreover, this is ever more difficult with indirect referencing and the use of spreadsheet variables. We isolate the formula and portray it visually. An example of a formula is shown in Figure 2.

Figure 2.

A visual representation of the formulas from a spreadsheet for credit risk rating

Once decision logic within the spreadsheet has been modeled with business rules, analysts can test the outcome with benchmark data. With this exposure of the logic of the spreadsheet, we have an opportunity to streamline and optimize the logic of the decision.

Closing the Analytics-Business Analyst gap

Business rules, in addition to promoting communications between business and IT, also improve communications between business analysts, and operations researchers and statisticians.

Statisticians and operation researchers understand a lot about the numerical methods in analytics. They are also adept at developing elegant models. Yet, an understanding of the goals and objective of the processes that these models support requires the business experts of the company. Complete tests for processes such as risk management and derivatives contracts are complex, and they should be specified and tested only by business people. Cooperation often ends with the specification of the model and integration of far-flung components and work flow. IT takes charge of implementation and testing. The result is costly business errors. Business rules use analytics (analytic business rules) as a part of the support. As our experience has shown, other business rules define the logic for model selection, scoring, and evaluation. A comprehensive approach to decisions that incorporate conventional predicate business rules and analytic logic offers an enormous increase in efficiency.

A visual solution to analytic business rules algorithms offers obvious benefits:

- Variables and functional structures do not need to be declared; the solution is more direct.

- Java or C++ does not need to be learned to create, test, debug, and solve an algorithm.

- The solution is more compact, and it is simpler for others to maintain.

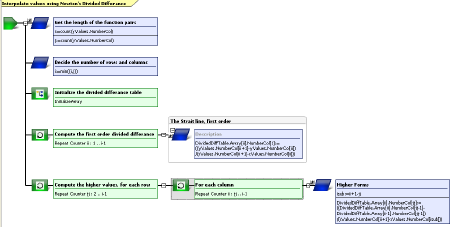

Certainly, decision tables and rule flows are simple ways to develop and model decisions. Yet, they should be used appropriately. The analytic business rules implement logic as a series of logic trees, loops, and expressions. For instance, Figure 3 presents a portion of a common analytics algorithm, the Newton Divided Difference solution to solving differential equations.

Figure 3.

A visual representation of the factor portion of the divided difference algorithm

The role of business rules is to understand, institutionalize, improve, and control all the components of a business model. When they are digitized, business rules improve the quality and reduce the cost of application development. Using a business rules approach to develop and maintain decision-point analytics reduces computer coding and increases an organization's knowledge retention. Without a formal business rules approach, an organization gathers rules and analytic algorithms through legacy, paper-oriented procedures or a loose tale of data models and 'use-cases'. Implementing analytics in computer code complicates the construction of a decision rule-set. As the last article of the Business Rules Manifesto states: "Rules, and the ability to change them effectively, are fundamental to improving business adaptability." A business rules approach to analytics is an increasingly-important aspect of this goal.

References

Tom Debevoise, Business Process Management with a Business Rules Approach, Book Surge (2005).

Ronald G. Ross, The Business Rule Book: Classifying, Defining and Modeling Rules, 2nd Ed., Business Rule Solutions (1997).

James Taylor and Neil Raden, Smart Enough Systems: How to Deliver Competitive Advantage by Automating Hidden Decisions, Prentice Hall PTR (2007).

# # #

About our Contributor:

Online Interactive Training Series

In response to a great many requests, Business Rule Solutions now offers at-a-distance learning options. No travel, no backlogs, no hassles. Same great instructors, but with schedules, content and pricing designed to meet the special needs of busy professionals.